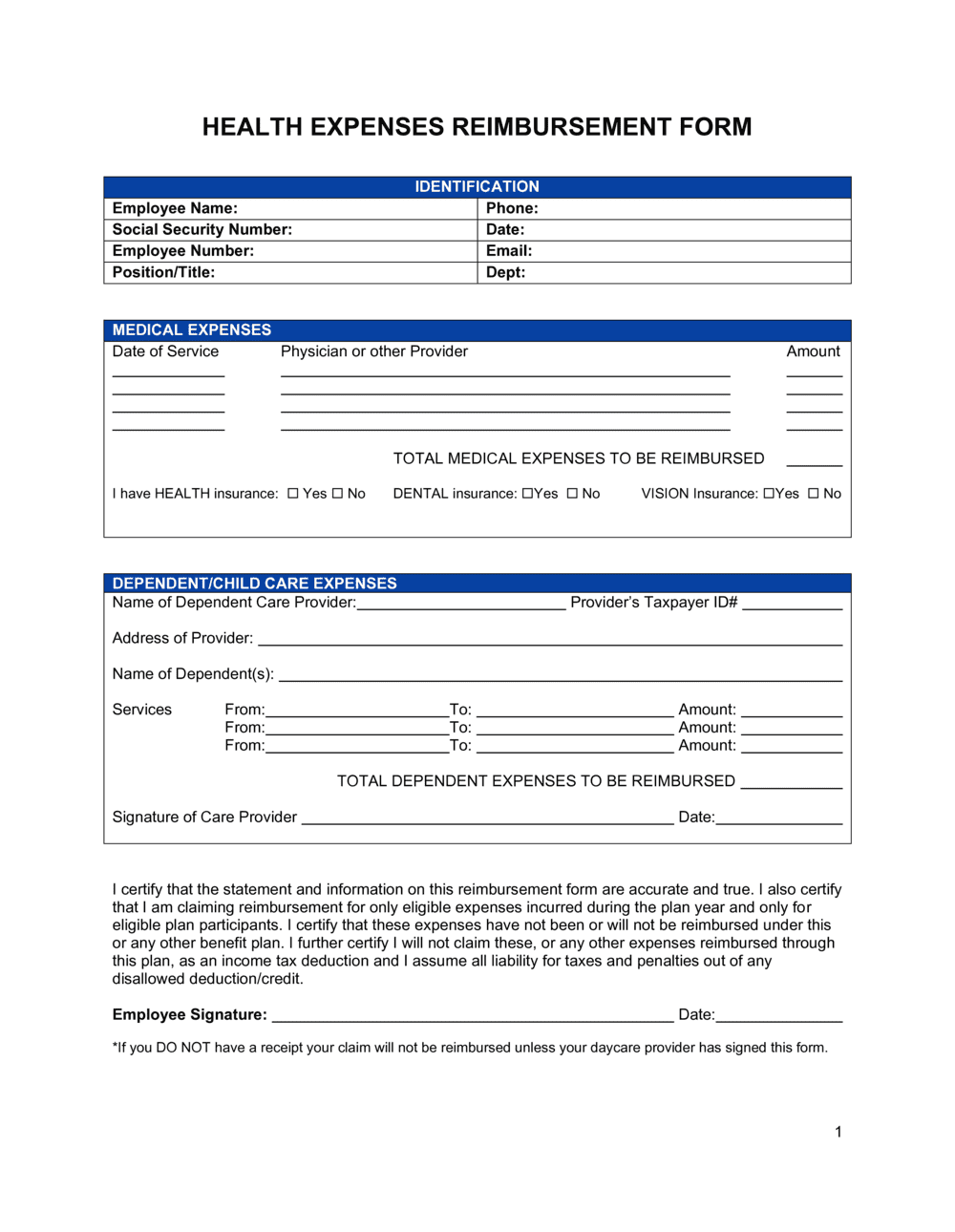

In any case, the expenses are not deductible if they are reimbursed by insurance or any other programs.

#Write off medical expenses license#

A medical license is not required to provide this type of care.

Custodial care can include assisting a resident with personal care needs, such as dressing, bathing, preparing meals, or doing laundry. If the assisted living resident is receiving custodial care (not medical care), the costs are deductible only to a limited extent. Then the room and board may be deductible, just as it would be in a hospital. the care they receive is being performed according to a certified care plan.the resident is in the facility primarily for medical care and.

Room and board for a facility may be considered part of the medical if: Generally, only the medical component of assisted living costs is deductible and ordinary living costs like room and board are not. Though not required by law, most assisted living facilities prepare care plans for their residents.Īre Room and Board Living Costs Deductible? This means a doctor, nurse, or social worker must prepare a plan outlining the specific daily services the resident will receive. be receiving personal care services according to a plan of care prescribed by a licensed health care provider.requires supervision due to a cognitive impairment (such as Alzheimer's disease or another form of dementia).cannot perform at least two activities of daily living (ADL's), such as eating, toileting, transferring, bath, dressing, or continence or.This means a doctor or nurse has certified that the resident either: In order for assisted living expenses to be tax-deductible, the resident must:

0 kommentar(er)

0 kommentar(er)